An Insurance Giant Through its Life Insurance Dashboard Analysis

Analyze sum assured, annual premiums, claim amounts, and total policies. We helped our client leverage its business data to monitor key KPIs across the organization and enabled business users to make data-informed decisions with intuitive dashboards

Industry

Insurance

Business Functions

Risk Management, Business Operations

Solution Delivered

Data Analytics, Dashboard Designing & Development

Technologies

Tableau & Power BI

Geography

Singapore

Our Customer

This customer is one of the biggest Insurance companies in East Asian countries. For the insurance industry, prioritizing and accelerating digital transformation and data-driven efforts to improve operations, customer experiences, and risk management is the most important activity.

The current requirement of dashboards was to set up a mechanism that can perform the following tasks in order to make data-informed decisions.

- Monitor regulatory compliance

- Track insurance frauds

- Manage audit processes

- Leverage powerful analytics

The Key Challenge of Our Client

Insurance is a data-centric industry and insurers have collected a huge amount of customer data till now. But monetizing this data and finding business insights with legacy systems, products, and business models is a time-consuming and complex process.

Our client wanted a data-driven system backed by data analytics to give intuitive & interactive dashboards for every business unit.

Our Objective in Solution Designing & Development

With insurance customers moving online to interact with brands, our client wanted a better system for managing claims better, quickly detecting fraud, improving service to customers, and understanding employee trends and their impact on the business.

What was the Outcome of Our Solution?

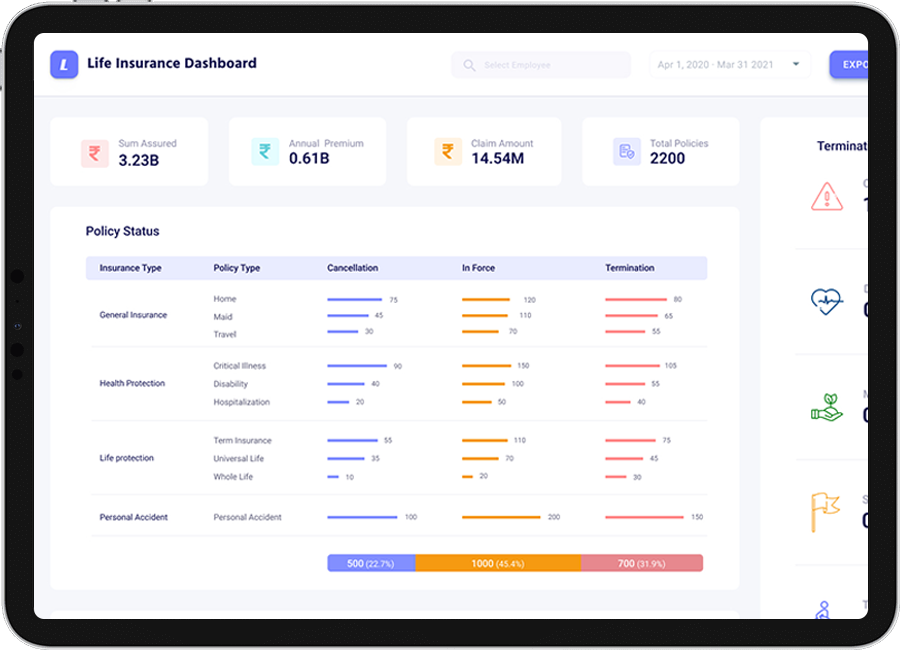

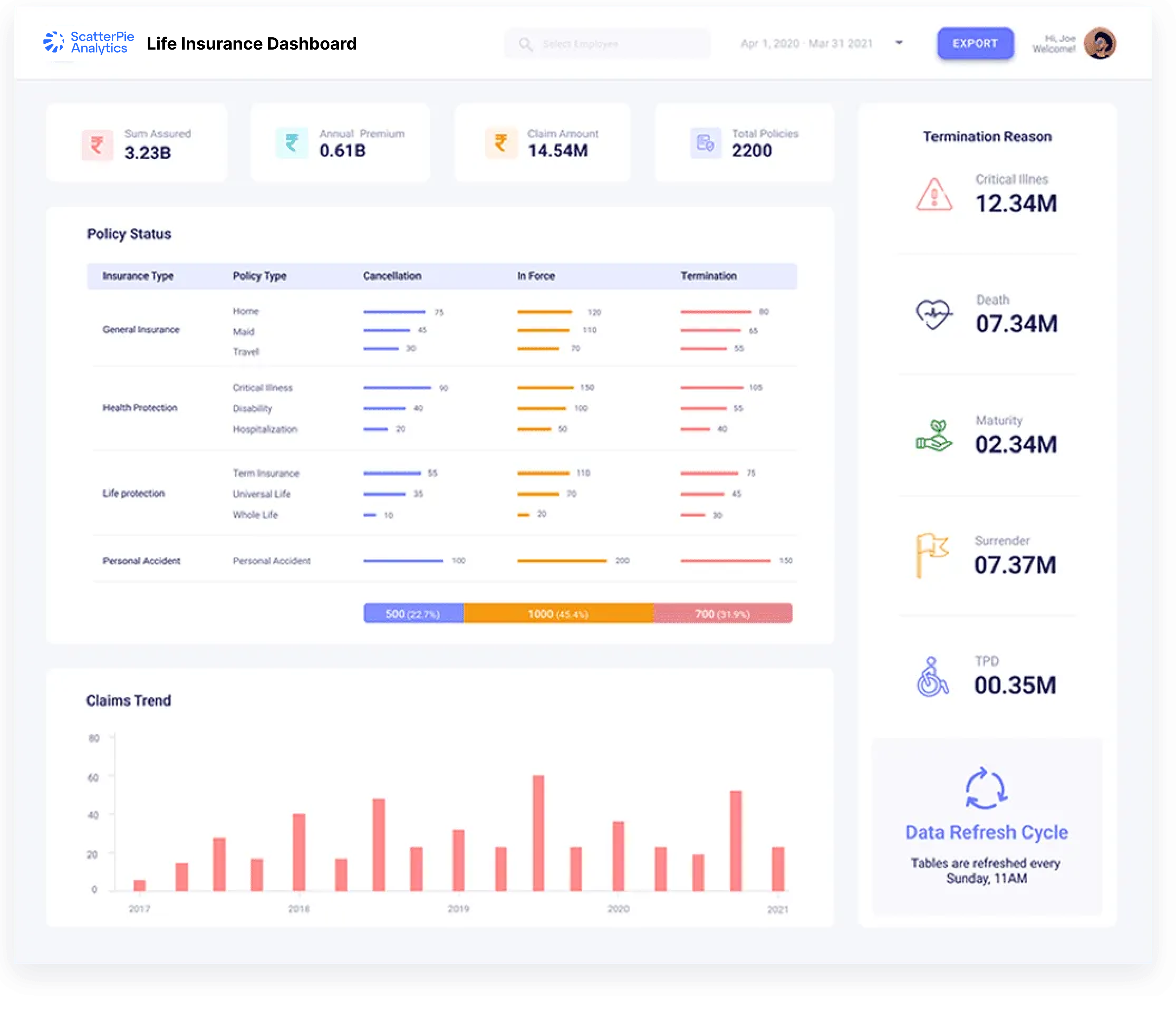

As an outcome, the ScatterPie team provided a Life Insurance dashboard for vertical managers. For them, this is critical to reference to stay up-to-date on claims trends, termination reasons, and policy status by product line, across territories, and get a glance at key KPIs such as cancellations, in force & terminations.

Solution Provided by Our Dashboards

ScatterPie business analysts analyzed the existing decision-making from legacy systems, excel to track captured data points and the list of KPIs. We suggested a dashboard for insurance leaders to see their sum assured, annual premiums, claim amounts and total policies.

The dashboard users can now see a high-level summary about the sum assured, annual premiums, claim amounts, total policies for the selected period.

The areas covered in the delivered solution were

Termination Reason Analysis

For claims managers, this is critical to stay up-to-date on Insurance termination by product line, across territories. Dashboard users can see reasons for termination like:

- Critical Illness

- Death

- Maturity

- Surrenders

- TPDs

Policy Status Analysis

Getting visibility in the policies to analyze In-force, terminated, and canceled policies across product lines gives better control over the business.

Claims Trend

Claims trend provides visibility into and assesses how much you pay out in claims, and with what frequency. Understanding claims trends can help you make strategies and forecast the claim counts.

Benefits Our Client Now Enjoys

ScatterPie’s solution resulted in the following benefits:

- Tracking Policies, Claims, and Terminations in an organized manner.

- Getting visibility in the day-to-day operations & claims.

- Timely emails to stakeholders with the most important KPIs to track.